Yen Falls On Japan Fin Min Comments

Intervention Risks Back in Focus

The Japanese Yen is rallying today with USDJPY down around 0.5% in early European trading. The move comes amidst renewed intervention risks on the back of the recent push higher in USDJPY. This morning, Japanese fin min Katayama signalled that FX intervention remains a possibility and referred to a joint statement signed with the US last year which included options for joint intervention. Such a move would be unprecedented and could help significantly alter the USDJPY rate where the BOJ gas typically struggled to achieve a sustained reaction in response to prior intervention events. Given the reaction we’re seeing in JPY today there is clearly some caution among traders that intervention is coming.

Hawkish BOJ Expectations

These comments came alongside a report from Reuters this week signalling that sentiment within the BOJ is more hawkish than markets currently perceive. Political developments in Japan have exacerbated JPY weakness recently. PM Takaichi is preparing to dissolve the lower house and hold a snap election. If the fiscally dovish PM succeeds in gaining more seats for the LDP this could put greater pressure on JPY raising intervention risks further near-term. Focus now turns to next week’s BOJ meeting where hawkish risks are seen higher now.

Technical Views

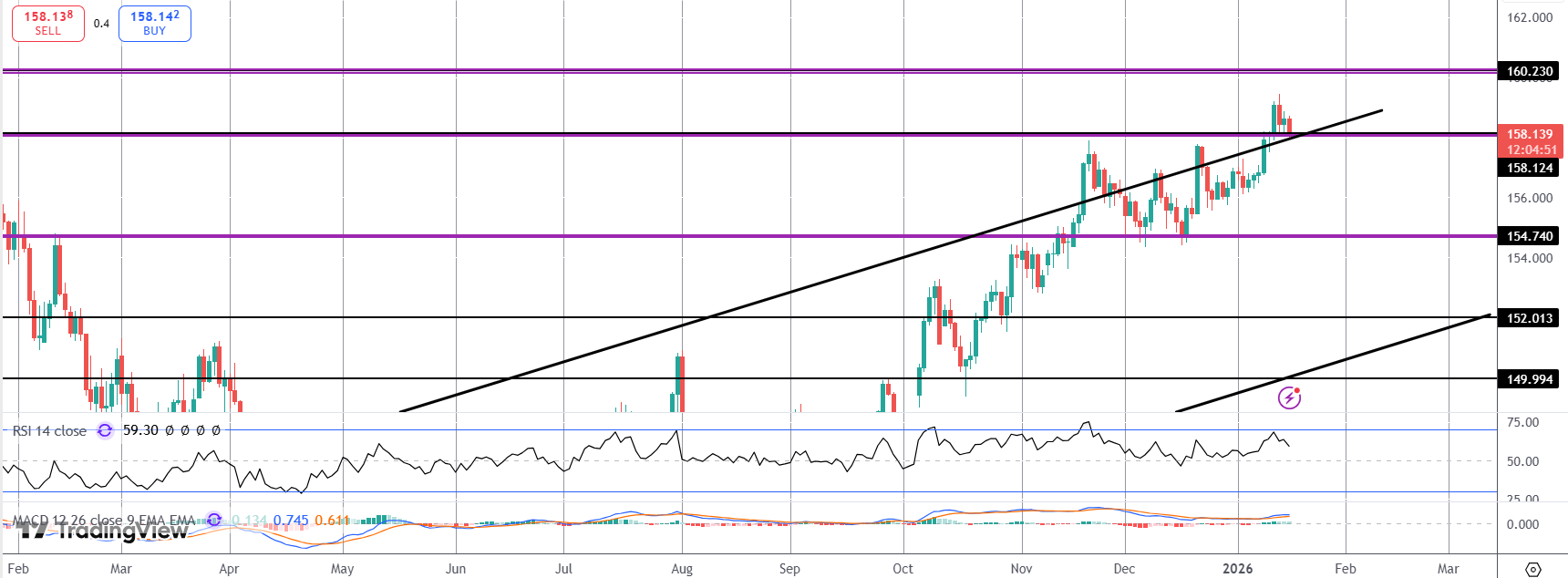

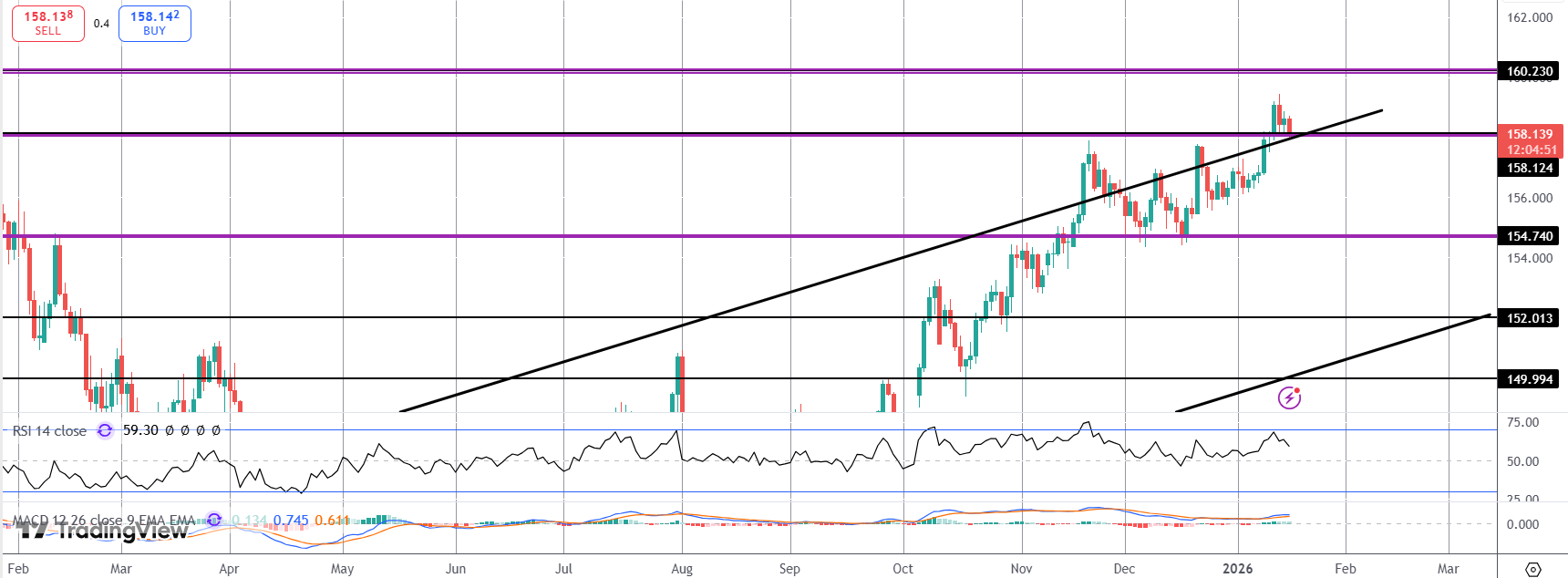

USDJPY

The pair is currently retesting the broken bull channel highs and 158.12 level. While this area holds as support, focus is on a continued push higher with 160.23 the next bull target. If we slip below that area, however, focus turns to deeper support at 154.74 next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.