The FTSE Finish Line 23/9/25

London shares saw a slight uptick on Tuesday, driven by retailers, as a weaker pound provided additional support to the exporter-focused FTSE 100 index. An index tracking retail stocks increased by approximately 3%, driven by a 15.2% jump in Kingfisher, as the home improvement retailer upgraded its profit forecast for the full year following a stronger-than-expected first half. The company's shares were poised for their largest single-session percentage increase since 1986. Other significant retailers also saw gains, with JD Sports Fashion climbing 1.6%, Frasers rising 2.3%, and Howden Joinery up by 3.5%. The British pound weakened, providing additional support for export-oriented companies, after a report indicated a slowdown in British business activity in early September. Additionally, another survey released on Tuesday revealed that British businesses have experienced a decline in momentum and confidence in anticipation of potential new tax hikes in Finance Minister Rachel Reeves' upcoming budget in November, along with a further decrease in hiring. Last week, the Bank of England maintained its benchmark interest rate at 4% and stated that it is watching for any signs of easing inflationary pressures before lowering borrowing costs again. The larger healthcare sector fell by 1.3%, primarily due to a 9.2% drop in Oxford BioMedica's stock following the release of its half-year results. Attention was also focused on GSK after the Trump administration urged pharmaceutical companies to be ready to increase production of leucovorin, a type of folic acid used as a treatment for certain autism patients. GSK had previously produced leucovorin, marketed as Wellcovorin.

Kingfisher's shares surged 17.4% to 296.2p, reaching their highest point since May. The home improvement retailer emerged as the top gainer on the FTSE 100, which increased by 0.12%. The company is targeting the "upper end" of its fiscal year adjusted pre-tax profit forecast of £480-540 million ($648-$730 million), compared to £528 million in 2024/25. It reported a first half adjusted pre-tax profit of £368 million, a 10.2% increase attributed to higher retail profits and reduced net finance costs. Chief Executive Thierry Garnier stated, "Our expectations for our markets for the year remain consistent with what we outlined in March, while being mindful of mixed consumer sentiment and political uncertainty." Year-to-date, with the session's gains included, the stock has risen 1.41% compared to the FTSE's nearly 13% increase.

Smiths Group's shares rose by 4% to 2,472p, reaching a record high and becoming the second-largest gainer on the FTSE 100 index. The company reported a fiscal year (FY) headline operating profit of £580 million ($783.35 million), reflecting a year-over-year organic growth of 13.1%. For FY26, the company anticipates organic revenue growth of 4-6% along with margin expansion, while reaffirming its improved medium-term targets. With today's gains included, the stock has increased by 44.27%.

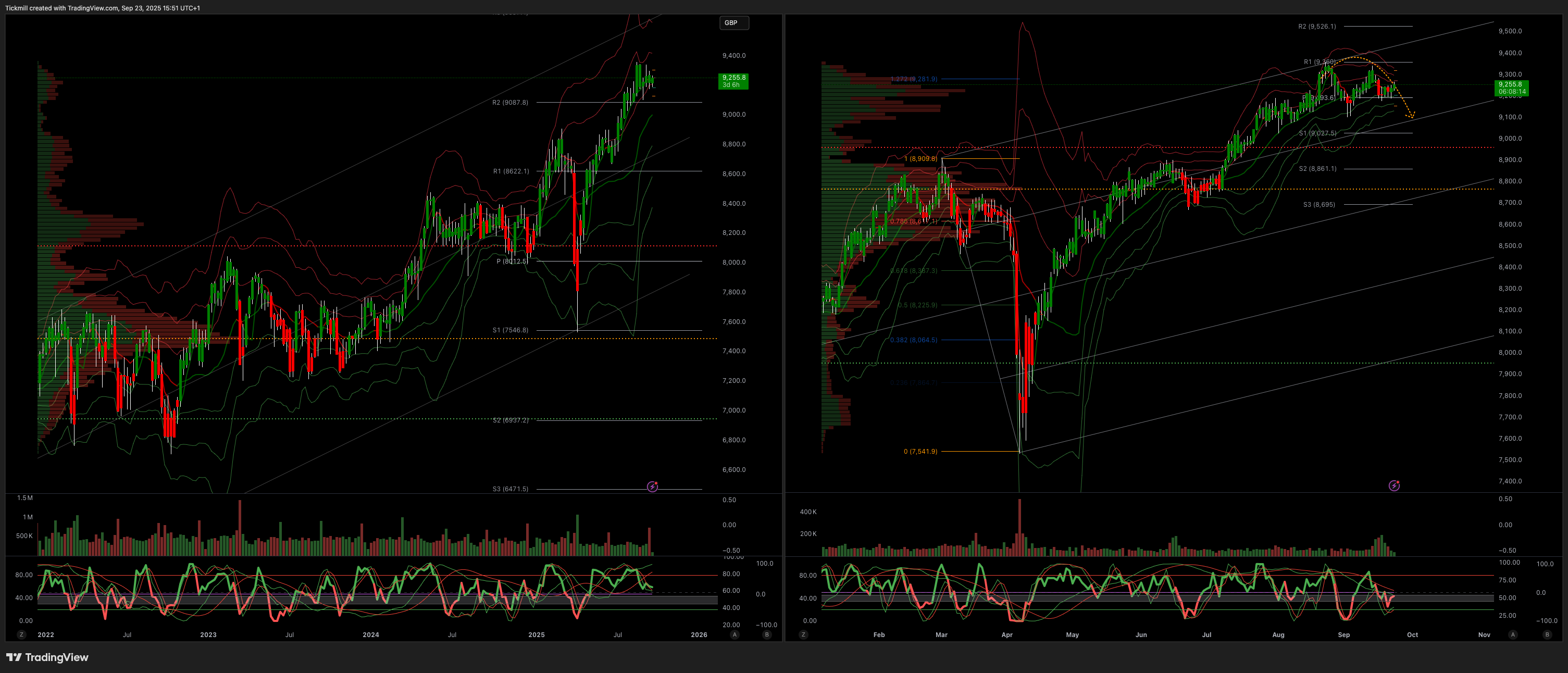

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9000

Primary support 9000

Below 8900 opens 8600

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!