Gold Soaring On US/China Fears & Dovish Fed View

Trump Trade Uncertainty Returns

Gold prices are enjoying a perfect storm of bullish drivers currently. The futures market has been in firm ascent over the last month and shows no signs of slowing down as price continues to print fresh record highs today. A combination of dovish Fed expectations and fresh uncertainty over US/China trade is seeing demand for the yellow metal surging higher. A return to hostile trade rhetoric between the US and China has sparked a pullback in risk assets which is feeding into higher gold prices here and looks set to continue near-term while tensions remain elevated.

Dovish Powell Comments

Yesterday, Fed chairman Powell sparked fresh selling interest in USD as he warned that the bank was nearing a point when QT would be brought to an end. Powell signalled that such a move would likely become appropriate in the coming months given the growing risks to the labour market and the need for greater economic support. Powell explained that the bank had been in a difficult position due to the strength of the labour market earlier in the year, and residual inflationary risks. However, with the labour market having suffered a sharp downturn in recent months, risks have fallen more in line, creating a clearer policy path for the bank. With the Fed widely expected to press ahead with at least a further .5% worth of cuts this year, gold prices look set to continue higher as USD pulls back.

Technical Views

Gold

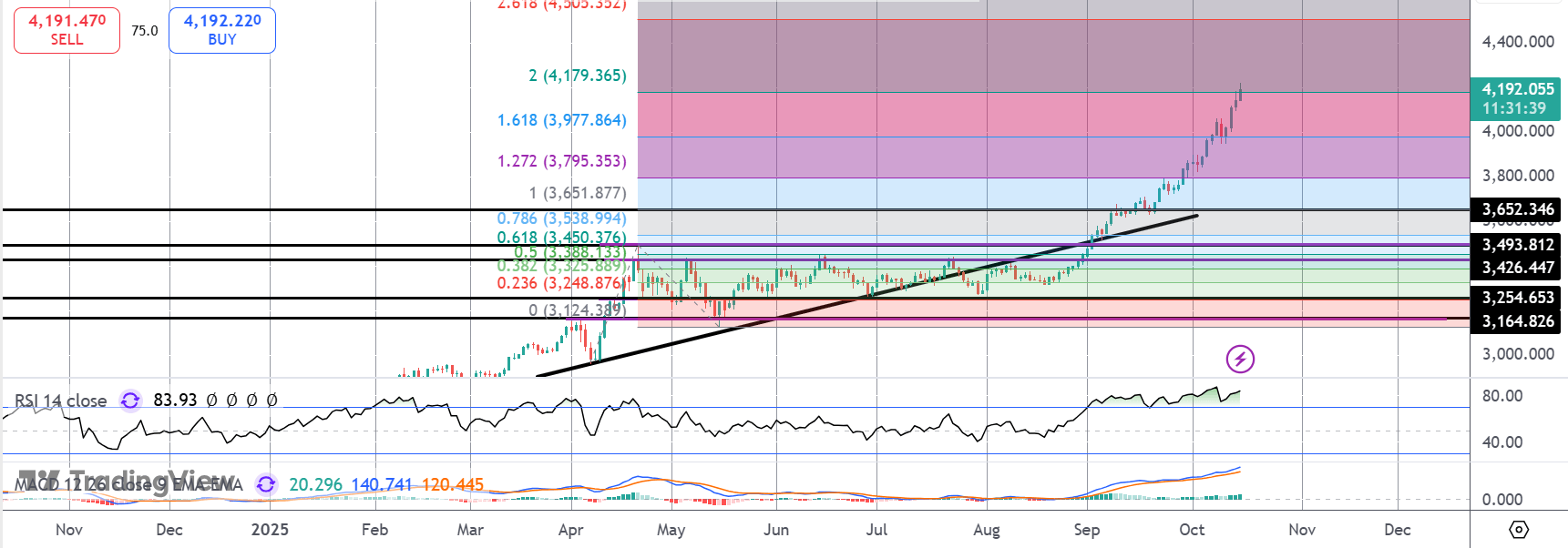

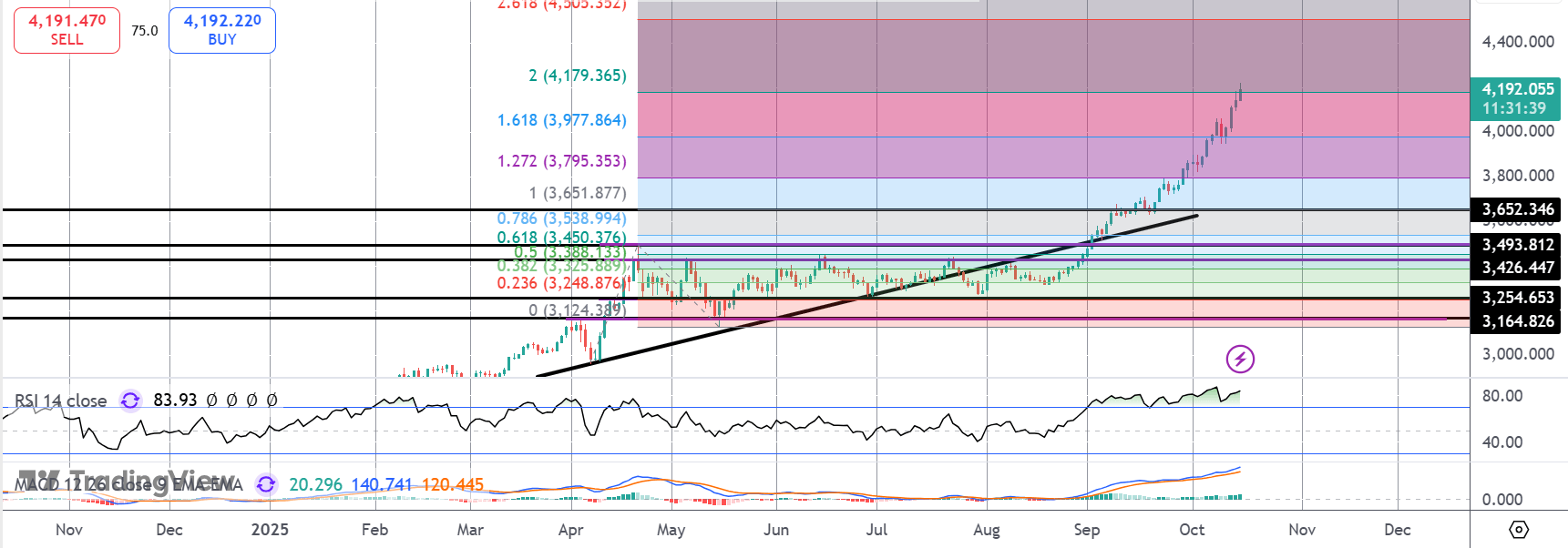

The rally in gold continues to push higher with price now trading above the 1.61% Fib level. With momentum studies bullish, focus is on a continuation higher with the 2% Fib level around 4,505 the next target for bulls. To the downside, the broken 1.27% Fib at 3,977.84 is the key support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.