FTSE 100 FINISH LINE 10/10/25

FTSE 100 FINISH LINE 10/10/25

The UK's leading FTSE 100 index dipped for the second day in a row on Friday, as declines in major mining and industrial stocks overshadowed the positive momentum seen in consumer-focused shares. However, heading into the close, the benchmark is hogging the flatline, fluctuating between marginal gains and losses as investors square positions heading into the weekend. Industrial stocks took a hit, with the aerospace and defence sector leading the downturn, dropping 2.2%. Rolls-Royce saw a 2.1% decline, becoming the heaviest drag on the FTSE 100. Similarly, BAE Systems and Melrose slipped by 2.3% and 2.4%, respectively. Resource-related sectors also faced challenges. Precious metal miners tumbled by 2.9%, while energy stocks dipped 0.9%, both reflecting declines in gold and oil prices.

Endeavour Mining and Fresnillo ranked among the FTSE 100's biggest losers, as investors cashed in on gains following the recent market surge, sparking the question of whether this cash would be reinvested into fresh opportunities or held back for bargain hunting during a potential market correction. The benchmark index faced significant pressure from banking stocks, particularly after HSBC revealed plans to privatise a Hong Kong bank on Thursday. This weighed heavily on the index, despite it reaching record highs earlier in the week. However, weekly gains in base metal miners and utilities offered a glimmer of hope, suggesting the index might remain in positive territory for the week—provided these levels hold steady. On the downside, Ibstock experienced a sharp decline of 5.7%, hitting its lowest point in over nine years. The bricks and concrete manufacturer issued a warning that its annual profits would fall short of expectations. This slump made Ibstock the worst-performing stock on the domestically focused FTSE 250, dragging down the broader construction sector by 1.1%. In contrast, consumer staples stocks showed resilience, with beverage companies climbing 1.5%, and personal care, pharmaceutical, and grocery firms gaining 1%.

Recruitment firm Hays emerged as the standout performer on the FTSE 250, surging 5.1% following a promising first-quarter trading update. Hays shares climbed 2.15% to 58.89p after the company announced a 8% year-on-year drop in Q1 group net fees on a like-for-like basis, aligning with the company-compiled consensus estimate of -8%.RBC described the quarter as "something of a holding period," citing ongoing uncertainty in the macroeconomic environment, particularly in Europe. However, they noted that progress in key self-help initiatives should bring some comfort to long-term investors. Despite the challenging economic backdrop and tough conditions in permanent hiring, CEO Alistair Cox highlighted a "normal recovery" in activity levels post-summer, with trading remaining stable on a seasonally adjusted basis throughout the quarter. Year-to-date, Hays shares have fallen approximately 27.2%, even after factoring in today's gains.

Next week the UK has a busy agenda starting with labour and wage figures on Tuesday. The Bank of England will be closely monitoring for signs of easing pay growth while hoping that labour market weakness remains mild. Risks appear tilted toward stickier wage growth and a decline in private-sector employment. Monthly GDP and industrial production data follow on Thursday. While GDP may find support from services, production remains weak, with Q3 growth likely slower compared to H1’s pace

Technical & Trade View

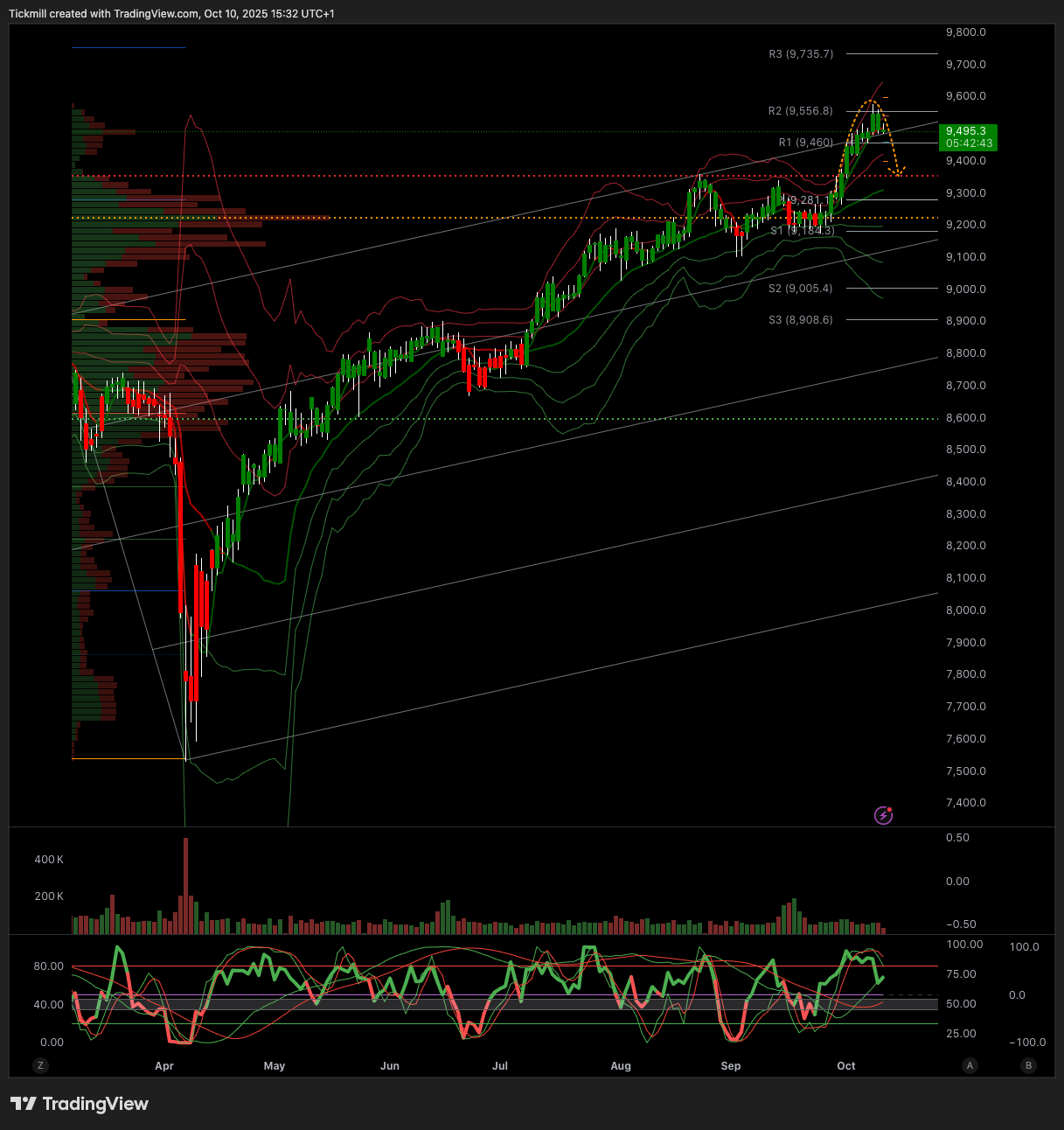

FTSE Bias: Bullish Above Bearish below 9300

Primary support 9000

Below 9300 opens 9000

Primary objective 9600

Daily VWAP Bullish

Weekly VWAP Bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!