Crude Oil Sinking - YTD Lows In Sight

Crude Slide Deepens

Crude futures continue to push lower on Friday and are fast approaching a fresh test of the YTD lows. Now down around 6% on the week, and more than 10% from the month’s highs, risks of a fresh downside break are seen. Fear over fresh tariff threats between Trump and China ahead of the upcoming Nov 10th trade deadline have sparked a wave of risk aversion across markets. The prospect of a return to all-out trade war between the two economic superpowers is weighing heavily on crude demand with the market plunging accordingly.

Israel-Hamas Peace Deal

Crude prices have also been weighed on by the recent peace deal between Israel and Hamas. With Israel ending its military operations in Gaza, traders deem there to be a lower risk of supply disruptions linked to violence in the region. While the peace deal holds crude prices look likely to move lower near-term as traders recalibrate risks to supply in the Middle East.

US/China Trade on Watch

For now, the key focus will remain US/China trade relations. If tensions continue and it looks as though tariffs will rise again on Nov 10th, crude markets have furtehr to fall alongside a broader decline in risk assets generally. However, if we start to hear any improvement in tone crude could start to recover. If an extension or a trade deal is then agreed, this will be firmly bullish for risk markets with crude likely to rally sharply on such news.

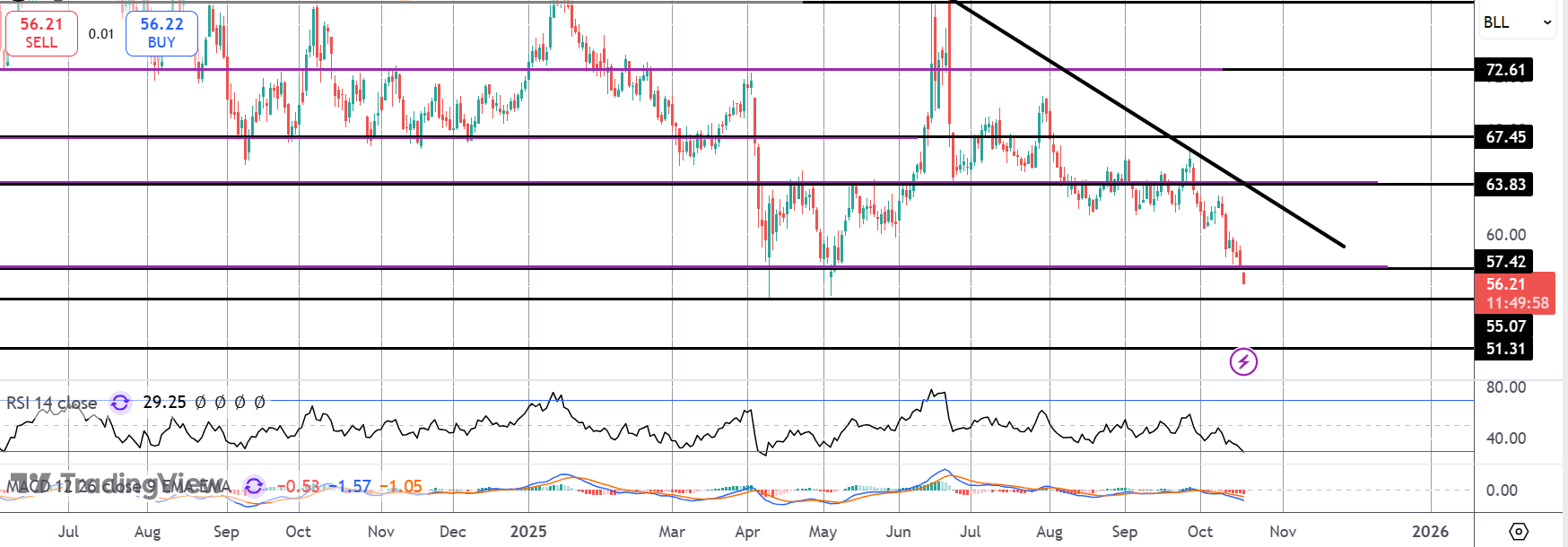

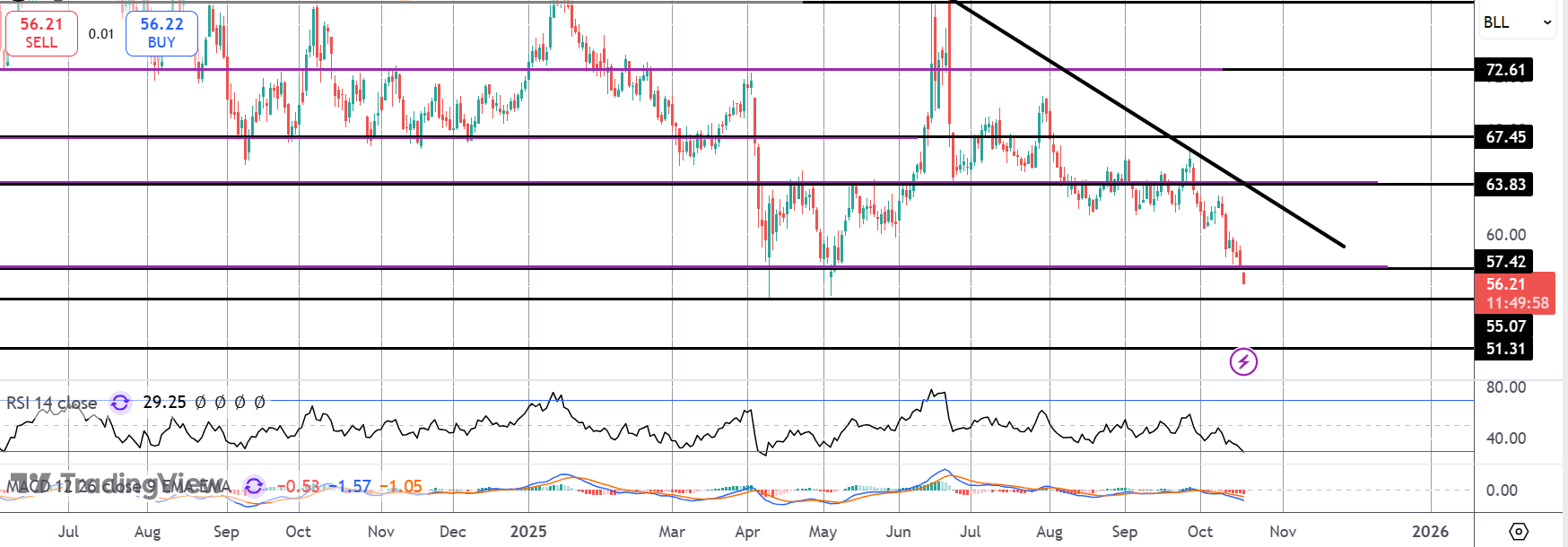

Technical Views

Crude

The sell off in crude has seen price breaking below the 57.42 level, now fast approaching a test of the 55.07 YTD lows. With momentum studies bearish, risks of a fresh break lower are seen with 51.31 the next support to note. For now, the bearish outlook remains while price holds below the bear trend line.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.