Bitcoin Falls As Risk Aversion Takes Hold

BTC Weaker Amidst Risk-Off Atmosphere

Bitcoin prices have comes under heavy selling pressure today with the futures market plunging hard amidst the broader tone of risk aversion we’re seeing on Monday. BTC is down around 3.5% on the session extending losses from the reversal from last week’s highs. Risk assets are generally weaker today on news of Trump’s tariff threat against the EU and the risk of a fresh trade war developing. Trump is increasing the pressure in his attempt to secure Greenland and wider risks are now emerging with EU leaders currently weighing up options to launch countermeasures if tariffs go ahead.

Trump & EU Leaders to Speak

Looking ahead this week, traders will be awaiting speeches from Trump and EU leaders midweek from the Davos forum. Trump is due to speak on Wednesday and with the likelihood that we hear more hawkish rhetoric from him, BTC looks vulnerable to fresh downside. This dynamic is further exacerbated by the rise in gold which is emerging as the preferred safe-haven amidst the current risk-negative, USD-negative environment. If the US/Greenland situation escalates this week (hawkish Trump rhetoric followed by EU response on Thursday) BTC could head back down towards YTD lows.

Technical Views

BTC

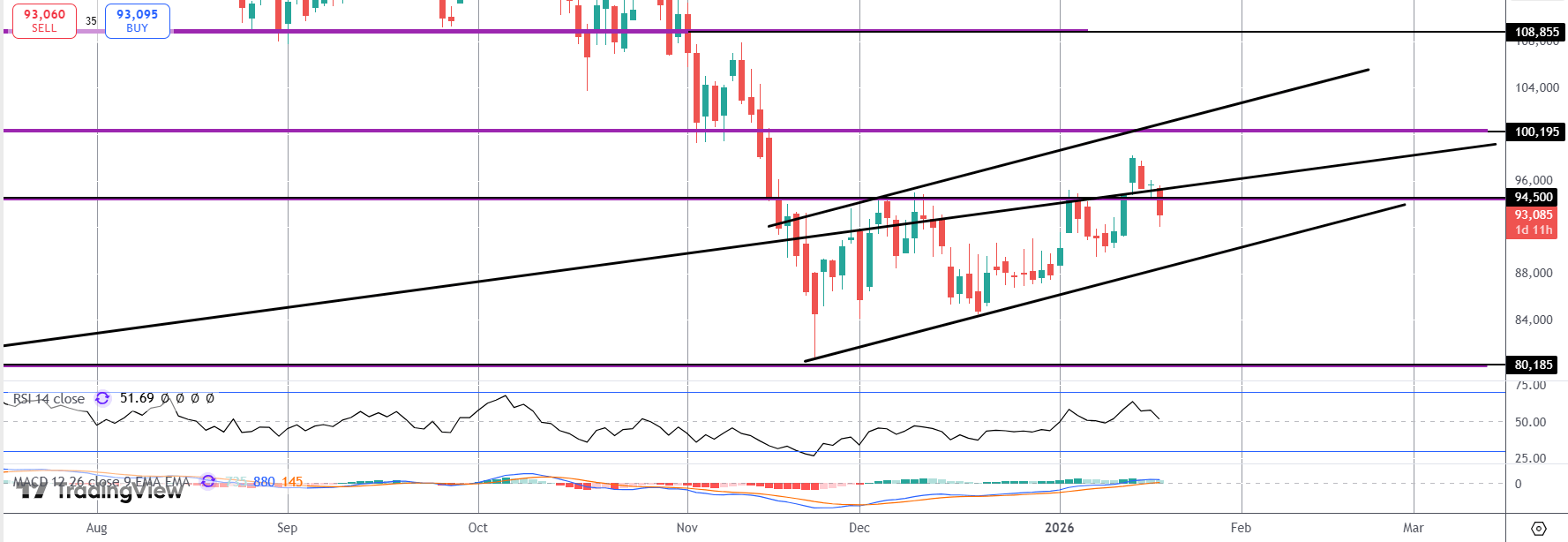

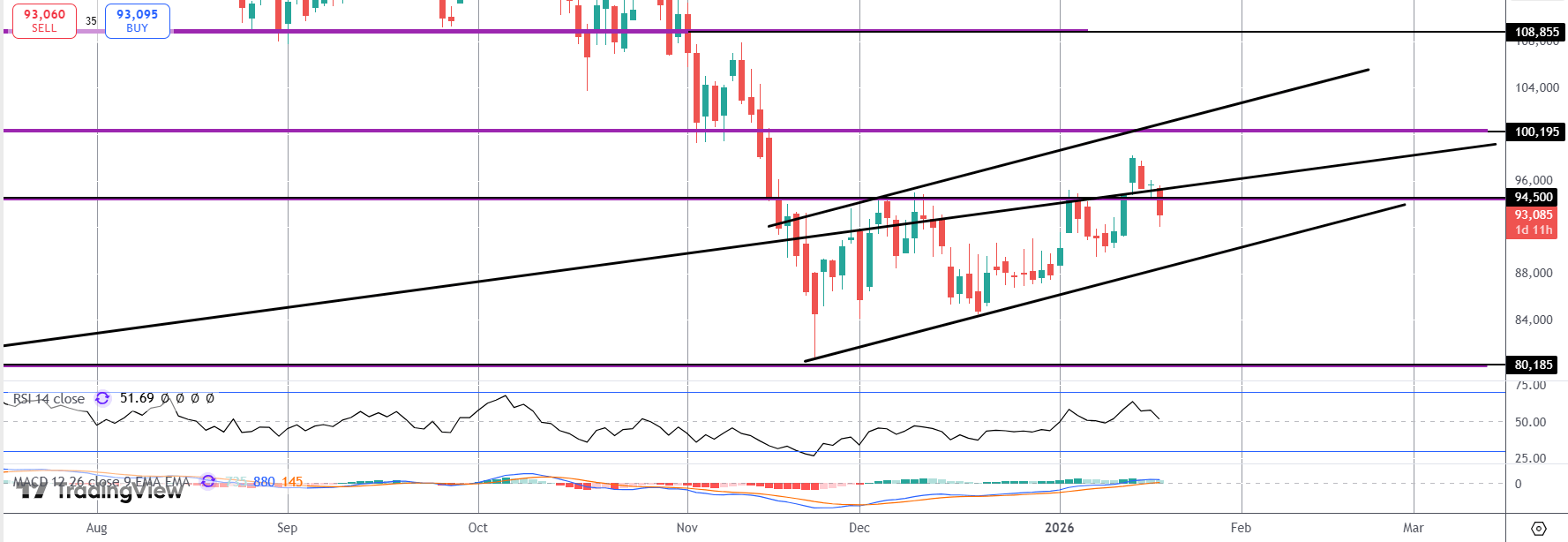

The sell off in Bitcoin has seen price breaking back under the $94,500 level and the broader bull channel lows. With momentum studies turning lower, risks are skewed towards a deeper push. The corrective bull channel from November lows is the local structure to consider with those channel lows the initial support to note ahead of the $80,185 .

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.